US President Donald Trump and his impact on the resource sector were key topics of conversation at the latest Metals Investor Forum, which returned to Vancouver, BC, from January 17 to 18.

In his talk, John Kaiser of Kaiser Research asked the audience, ‘In what way is America truly no longer great?’

To answer, he reviewed the state of the junior resource sector and delved into how Donald Trump’s second term as US president may ultimately impact the country’s mining sector.

Resource sector has lost its luster

Looking back to the 1990s, Kaiser said that times were good in the mining industry.

Several important discoveries garnered incredible attention, including Diamond Fields’ Voisey’s Bay nickel deposit, Arequipa Resources’ Pierina gold prospect and Bre-X’s now-infamous Busang discovery.

Despite tarnish from the Bre-X scandal, the resource sector remained strong through the 2000s. However, as the 2010s began, the market turned bearish. Kaiser’s presentation focused on the period from 2011 to now.

He detailed how funding in the sector began to decline at that time, with trading activity following closely.

‘I’ve broken down the monthly financing activity for TSX Venture resource juniors by the value range. And you can see that in the past decade, it has really shifted to a small group of very large financiers. So this is being done by the financial sector. It gravitates towards the more advanced, bigger companies,’ Kaiser explained.

‘The smaller juniors — the amount of money that they’re raising in the $5 million or less (range) — it’s kind of flatlined, and this is not really a healthy thing,’ he continued, adding that inflation is compounding these issues.

‘When you apply inflation to everything, it’s a serious problem, because of the compliance costs, permitting cycle costs — everything costs an awful lot more than it used to, a lot more than inflation-adjusted CPI. So the whole sector, especially the junior (companies), the smaller ones, they are being starved of capital.’

By Kaiser’s calculations, 50 percent of TSXV-listed companies have negative working capital, along with C$2.4 billion of debt that will never be repaid. And in his view, the problems in the industry are more than financial.

“What is really bad is there are no younger audiences coming in behind us,’ he said.

‘Gen Z, the Millennials, Generation X — they don’t care about this sector. They’re into stories where you don’t need to know anything, which is why Bitcoin is perfect,” Kaiser quipped.

He noted that a lot of the problem is the regulatory and permitting framework in Canada, which draws out timelines and makes the space unattractive to new investors. Kaiser also explained the troubles around short selling, which limits a company’s ability to see its stock price fully realized on discovery.

It’s not just the Great White North

The US is also facing challenges in the resource sector, albeit different ones.

“When I saw the election outcome, I said, you know, this problem is one area where America is no longer great. It’s going to become a crisis a lot sooner than it would have, say, if Kamala Harris had won the election,’ Kaiser said.

‘It was going to happen anyways, just not as fast,’ the expert added.

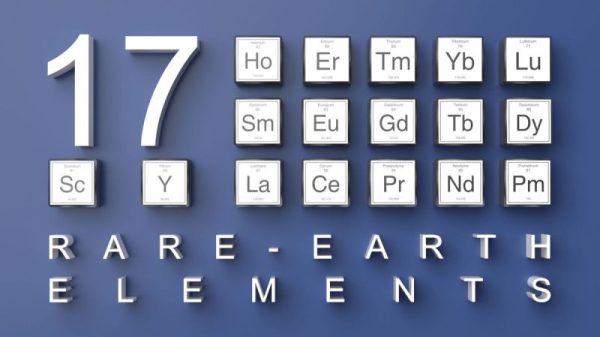

Since Trump’s first term, the US Geological Survey has become concerned about the country’s dependence on importing raw materials. While it’s become the world’s largest producer of oil and natural gas, the same cannot be said of other commodities, where the Global East has seen its production share rise.

It’s a problem that according to Kaiser started decades ago.

“After the end of the Cold War in 1991, globalization really became a thing; this helped China grow, and jobs and stuff moved everywhere else. We were exceptional. We don’t want that mine in our backyard. Let it be done in Congo, or China or somewhere else, and we’ll just buy the stuff and grow our economy,” he said.

The expectation was that China would see a shift to become more like the US. However, that didn’t happen, and ultimately, the world became increasingly bifurcated. Russia and China formed a Global East alliance that has been opposed to the Global West. Other members have joined this Global East alliance, including North Korea and Iran, and together they have been working to spread their influence through Asia, Africa and South America.

Kaiser suggested this has increasingly isolated the Global West and diminished its standing and influence in the world. He explained that when it comes to GDP, the Global West represents 50 to 52 percent, while the Global East is 20 percent, and the Global South is 9 percent. Looking over to raw materials, it’s a much different picture, with the east and south accounting for a much larger percentage of resources than the west.

“If the Global South starts throwing its lot in with the Global East, we have a serious problem, and this problem is going to be accelerated because Trump has not only declared war on the Global East, but he is also declaring war on everybody else, including his Global West allies,” he told the Metals Investor Forum audience.

This will further isolate the US, and will present challenges for other countries as they figure out how to keep their economies going while they deal with threats from the world’s biggest economy.

As mentioned, while the US is dominant in oil and natural gas production, it has become weaker in other areas, such as coal and uranium. China and Kazakhstan dominate these latter two. Aside from that the US produces almost no gallium, germanium and antimony, minerals that are critical to the semiconductor industry.

Looking forward, Kaiser sees a big challenge in copper. Canada, the US and Mexico currently produce enough copper to meet their own needs, but the energy transition, the drive to electric vehicles, data centers, and artificial intelligence make the situation less rosy. He suggested that America’s ability to meet its needs may be compromised if the Global South and Africa decide that doing business with the Global East provides a greater benefit.

To avoid this, Kaiser suggests that there is a great need to develop a domestic supply of critical minerals like copper.

Canada, the 51st American state?

Kaiser also issued a warning that Trump’s threat to make Canada a part of the US shouldn’t be taken lightly.

“I don’t think that should be taken as a joke. He may not know yet that he has a metal supply problem, but when that starts to bite hard, he’s going to look south at Mexico and find that would be best to take over,’ Kaiser said.

‘He’s going to look north to Canada and see its enormous unexploited bounty all paralyzed.’

In his view, the Canadian resource sector is stymied by a regulatory and permitting environment that stalls projects even before the development stage. Kaiser also noted that communities are fighting with companies instead of finding ways to work together so that they can mutually benefit from work in the mining industry.

He suggested that Canada provide more stimulus for the sector, cut red tape and encourage companies and communities to collaborate more — before Trump realizes the situation the US is in.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.